You have probably purchased cryptocurrency from a central exchange (CEX) like Binance, Bitget, etc... The most of cryptocurrencies that are trading on these exchanges are derived from related DeFi projects. You are trying to go to the project's website but there is no option for signing in or signing up, only a "Connect wallet" which needs you to install a separate application or a browser extension. The application is a self-custodial wallet. This article sorts out the issues why switching from custodial exchanges to self-custody can not only greatly enhance the security of your investments but also why the practical inconvenience of DeFi usage is quickly vanishing for typical everyday investors.

Who really holds your money on a CEX?

When you use a CEX:

- You put your cash or crypto in.

- The exchange updates your account on its internal database to reflect the deposit.

- The exchange is the one that has the wallets and private keys, not you.

This results in:

-

Counterparty risk Your resources are tied to the financial health, security, and integrity of just one company. The moment it gets attacked, mishandles risk, or becomes insolvent, your on-screen balances may no longer coincide with what is in the wallets.

-

Rehypothecation and opaque risk Exchanges may do things such as lending, staking, or otherwise reutilizing customer funds to increase their revenue, but often they are not informative enough about these activities. Most of the time you are barely aware of the extent of the leverage or risk they are taking with your money.

-

Regulatory and jurisdiction risk The ease or difficulty of getting to your money may hinge on regulations, local laws, or internal compliance decision-making. There might be occasions when accounts are frozen or restricted.

-

Single point of failure In case of a failure in the security measures at the institution, all of the millions of users will be affected at the same time. At a CEX, the danger that you face is in a single place, i.e., one institution. Although the technology (blockchain) is decentralized, your custody is not.

What "self-custodial" really means

Self-custody is when you are the one holding the private keys that allow to move your assets. In brief:

- Your money is kept in a wallet on some blockchain (like Sui, Ethereum, etc.).

- The keys for allowing the transaction are either in your hand or with a smart contract that works according to the rules laid down by you.

- Any person can check balances and transactions on-chain.

This alters the risk pattern:

- No risk of losing your funds to a counterparty – the decentralized protocol cannot “abscond” with your funds as a centralized custodian can.

- Open by nature – you do not have to trust the private database as much since you are free to verify balances, portfolio composition, and protocol logic on-chain.

- Programmable safety – the smart contracts can set and enforce rules such as multi-signatures, daily limits, or time-based locks.

Malicious actors can if they want to introduce malicious code in their smart contracts. Thus, every time you want to invest in a defi project, you should check its audit reports which are issued by specialized companies.

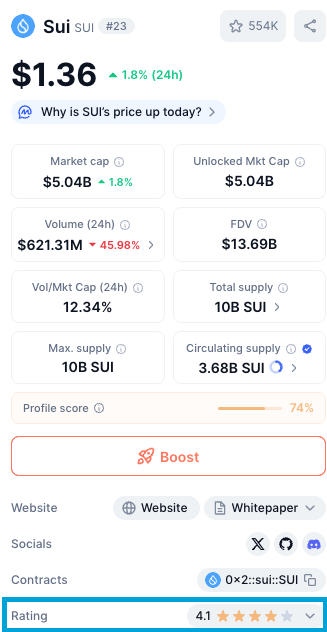

Nowadays the friction to do this kind of check is diminished by tools like Coinmarketcap, which expose parameters such as the rating, which rapresent a summary of several data sources:

The security comes from the fact that the smart contract is an implementation of some logic, and that logic is what a specialized company certifies, once it is certified that logic becomes immutable, so it cannot be silently updated by anyone, not even the creator.

Another risk of the self-custody is: if you are the only one who has a seed phrase and you lose it, no one will be able to recover your funds. In the past, this "personal responsibility risk" has been a cause that has driven away most retail investors.

The main point today: the problem of usability is being solved by technology at a very fast pace and without compromising the main security features of self-custody.

“But DeFi is too complicated for me”

Until very recently, this objection could be considered absolutely valid. Traditional self-custody DeFi demanded from you to:

-

Install a wallet extension

-

Securely write down a 12-24 word seed phrase

-

Be aware of gas fees and the network you are using

-

Manually connect to DeFi apps

-

Sign unfamiliar transactions For a person who is familiar with the process of logging into a CEX by using an email and password, this whole thing would look quite intimidating and fragile. The good news: a significant part of the industry efforts have been directed towards the goal of turning self-custody into something that feels more like a modern app and less like configuring a server. Some of the major trends are:

-

Login using socials You still can log in with the methods that you are used to (Google, Apple, etc.), the only difference is that the protocol keeps your assets in a self-custodial structure under the hood.

-

Account abstraction and smart contract wallets Your "wallet" might be a smart contract that can implement complex logic: social recovery, spending limits, and a lot more, rather than just a simple keypair.

-

Better defaults and safer UX Interfaces are becoming more and more capable of warning users about the actions that might be risky, simulating transactions, and facilitating the understanding of the structure of portfolios. As a result, the main reasons why most people have been choosing CEXs—convenience and familiarity—are getting progressively weaker, while the security benefits of self-custody are still there.

Lower friction to invest in Defi: Reactive Index

Reactive Index is a DeFi protocol that empowers investors to obtain non-custodial index tokens, which provide diversified baskets of assets with on-chain transparency and programmable, fixed-rule fees.

The app at index.reactive.finance is intended to complement this protocol by focusing primarily on a user friendly experience, lowering the usability barrier for everyday users.

Important points that would interest a user coming from a CEX:

-

Self-custody first Your portfolio is on-chain in a non-custodial manner. The protocol is not a central fund manager that keeps your assets off-chain; rather, it is an immutable smart contracts that control tokenized index funds.

-

Familiar login experience By the use of providers such as Google or Apple, instead of initiating a self-custodial account with a seed phrase, you can merely log in and create a self-custodial account of your own. So, it is still self-ctustodial behind the scenes: assets are held under smart contract logic and not a centralized exchange operator.

-

One-click diversification instead of manual DeFi trades When you trade on Defi, you need to consider several aspects to avoid losing part of the money during the trade (we will talk about this in a future article). You can simply be the holder of an index token that bundles the strategy into a single asset instead of manual swapping between multiple tokens, managing rebalancing and tracking various positions. The index’s constituents and rebalancing rules are available and can be verified on the chain, unlike a traditional fund whose back office is hidden.

-

Transparent, rule-based fees Management fees are set out in the protocol itself and, once a fund is deployed, cannot be changed arbitrarily by a single person, thus lessening the risk of unexpected fee hikes.

This from a user's point of view is a combination of:

- The convenience of a simple, app-like interface and a familiar login.

- The security and transparency of self-custodial DeFi.

How to think about your own next step

If you are planning to move your account from a CEX to DeFi, a reasonable approach would be to transfer only a small part of your portfolio to a self-custodial setup and familiarize yourself with the procedures. At the moment ReactiveIndex is in demo mode and it allows you to experience the whole process with currencies that don't have real monetary value in a manner similar to paper trading. However, the flow and the market conditions are the same as for the production app, so you can test without any risk at all, not even one cent.

Final note

This article is for informational purposes only and should not be considered as investment advice. Crypto and DeFi are risky and therefore you should only invest amounts that you can afford to lose.

Nevertheless, the path is quite evident: everyday investors will be able to use technology to hold their assets in completely transparent, self-custodial structures without having to compromise on usability. Transitioning from “trust the exchange” to “verify the protocol” is actually one of the most efficient ways that you can really enhance the safety of your investments.